HBAWV Newsletter – April 2023

Do You Have Items for Our Auction?

Click here for form to donate items.

Register for our Summer Meeting Today!

Registration Now Open!

We are excited to be holding our Summer Meeting at the Summit Bechtel Reserve in Glen Jean, WV!

We would like to thank 84 Lumber for sponsoring our hospitality room in the Sunset Lounge beginning Thursday, August 4th from 5:00 to 10:00 pm. It will also be open Friday, August 5th from 3:00 to 6:00 pm.

We are excited about our Build PAC Event, which will be held Friday evening, August 4th at Fenneman Great Hall and will be featuring a live acoustical performance by Matt Mullins.

The cut-off date to make your room reservations is Wednesday, July 19th by 10:00 am. Please call 304-465-2800 to make your reservations today.

Links to the schedule and the reservation form are below. Please complete your reservation form and email it to traci@omegawv.com or mail it to the HBAWV Office at 2006 Kanawha Blvd., E., Charleston, WV 25311 no later than Wednesday, July 19th.

Reservation Form

Meeting Schedule

If you have any questions, please contact the Association Office.

Employment Situation in March:

State-Level Analysis

Nonfarm payroll employment increased in 36 states and the District of Columbia in March compared to the previous month, while 14 states lost jobs. According to the Bureau of Labor Statistics, nationwide total nonfarm payroll employment increased by 236,000 in March, following a gain of 326,000 jobs in February.

On a month-over-month basis, employment data was strong in Texas, which added 28,600 jobs, followed by New York (+18,100), and Massachusetts (+16,300).

Fourteen states lost a total of 22,400 jobs. In percentage terms, employment in Delaware increased by 0.5% while Alaska reported a 0.4% decline between February and March.

Year-over-year ending in March, 4.1 million jobs have been added, marking a more than full recovery of the labor market from the COVID-19 pandemic induced recession. All the states and District of Columbia added jobs compared to a year ago. The range of job gains spanned 575,100 jobs in Texas to 2,000 jobs added in West Virginia. In percentage terms, Nevada reported the highest increase by 5.0%, while West Virginia increased by 0.3% compared to a year ago.

Across the 48 states which reported construction sector jobs data—which includes both residential as well as non-residential construction— 19 states reported an increase in March compared to February, while 26 states lost construction sector jobs. Three states remained unchanged. Texas added 5,800 construction jobs, while California lost 8,200 jobs. Overall, the construction industry lost a net 9,000 jobs in March compared to the previous month. In percentage terms, Kentucky increased by 3.1% while Connecticut reported a decline of 2.9% between February and March.

Year-over-year, construction sector jobs in the U.S. increased by 196,000, which is a 2.5% increase compared to the March 2022 level. Texas added 41,200 jobs, which was the largest gain of any state, while California lost 7,300 construction sector jobs. In percentage terms, Rhode Island had the highest annual growth rate in the construction sector by 11.9%. Over this period, West Virginia reported a decline of 7.5%.

March New Home Sales Jump on Lower Rates and Tight Existing Home Supply

NAHB’s latest Cost of Construction Survey reveals that 60.8% of the average home sales price consisted of construction costs in 2022, similar to the 61.1% breakdown posted in 2019. Since the inception of this series in 1998, this is just the fourth time construction costs represent over 60% of the total price of the home — it was 61.7% in 2013 and 61.8% in 2015.

The finished lot cost was the second largest cost at 17.8% of the sales price, down from 18.5% in 2019.

More.

Single-Family Starts Improve in March

Overall housing starts in March decreased 0.8% to a seasonally adjusted annual rate of 1.42 million units, according to a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. Within this overall number, single-family starts increased 2.7% to an 861,000 seasonally adjusted annual rate.

More.

Inflation Cools as Builder Sentiment Rises

The following is an excerpt from a recent Eye on the Economy newsletter written by NAHB Chief Economist Robert Dietz.

Data continue to show easing inflation, although certainly not at the rate the Federal Reserve and markets would wish. Nonetheless, signs suggest the Fed is near the end of its tightening cycle, which in turn sets the single-family sector on the path toward a rebound later this year and an outright calendar year increase in 2024.

Consumer prices in March saw the smallest year-over-year gain since May 2021, decelerating for the ninth consecutive month. While the shelter index (housing inflation) experienced its smallest monthly gain since November 2022, it continued to be the largest contributor (60%) of the total increase, less food and energy. Overall inflation was up 5% year over year in March, while shelter inflation was up 8.2%.

The Fed’s ability to address rising housing costs is limited, as shelter cost increases are driven by a lack of affordable supply and increasing development costs. Additional housing supply is the primary solution to tame housing inflation. The Fed’s tools for promoting housing supply are at best limited. In fact, further tightening of monetary policy will hurt housing supply by increasing the cost of AD&C financing. Nonetheless, the NAHB forecast expects to see shelter costs decline later in 2023.

Building material prices, as measured in the Producer Price Index (PPI) data, actually posted a 1% year-over-year decline in March — an indication of an overall slowing economy and an important leading indicator of where shelter prices are headed. That said, some items like electrical transformers remain a challenge for builders. As the shortage of distribution transformers continues, the PPI for power and distribution transformers increased 2% in March.

Prices have surged 63.9% over the past two years and declined in just two months during that span.

Builders remained cautiously optimistic in April, as limited resale inventory helped to increase demand in the new home market. Single-family builder confidence in April rose one point to 45, according to the NAHB/Wells Fargo Housing Market Index. Currently, one-third of housing inventory is new construction, compared to historical norms of around 10%. More buyers looking at new homes, along with the use of sales incentives, have supported new home sales since the start of 2023. Builders note that additional declines in mortgage rates (to below 6%) will further boost demand.

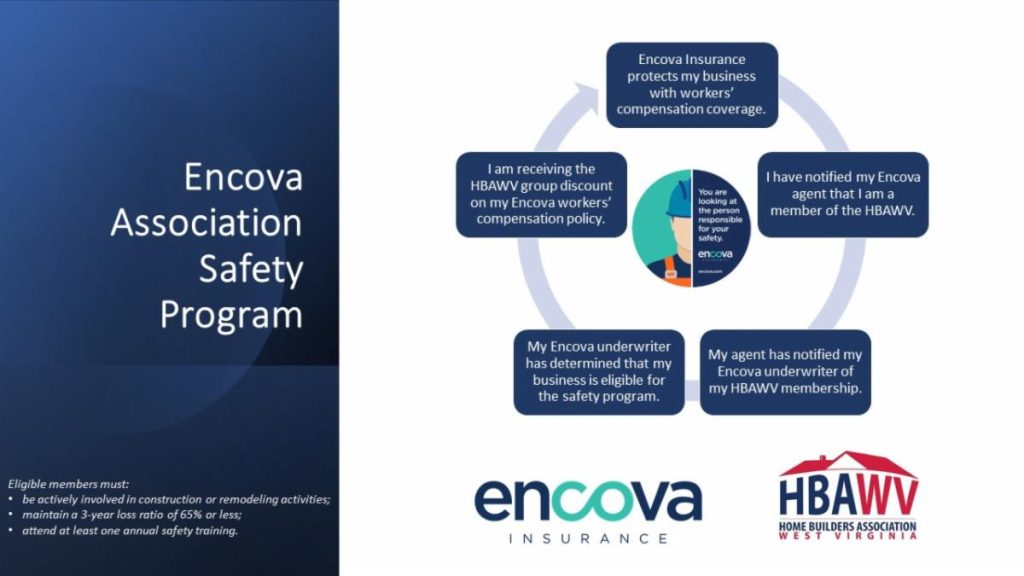

Encova new member discount for policies effective September 1, 2022 through August 31, 2023 will be 6.1%.

HBA Rebates Website:

www.HBAWVrebates.com

Now is the time for Builder and Remodeler Members to claim for Q1’23. Builder and Remodeler Members may claim for manufacturer rebates for residential jobs completed between January 1 through March 31, 2023.

New participating manufacturers have joined and are available for members to claim rebates beginning with Q1’23. Those new participating manufactures include:

GAF Roofing

Honeywell Home

Kidde Fire Safety

Panasonic Ventilation

Westlake-Royal Building Products

Personalized assistance is available. Please reach out to us with any questions. Claim Today, Don’t Delay! https://hbarebates.com/claimform/

Q1’23 Claim Deadline: Friday, May 26, 2023

Claim for Residential Jobs Completed January 1 through March 31, 2023.

HBAWV & MY BENEFIT ADVISOR NEW AFFINITY PROGRAMS PARTNERSHIP

CLICK HERE OR BELOW TO FINDO UT MORE

Share Your Good News With Us!

If you have something exciting going on with your company, proud of work you are doing in your community or just want to brag a little bit .. share it with us! We love to share good news!

Important Dates:

Future HBAWV Board of Directors Meetings

HBAWV Annual Auction – June 17th, 2023 – 500 Mylan Park, Mylan Park Lane, Morgantown

HBAWV Summer Board of Directors Meeting – August 3rd – 5th, 2023 – 2550 Jack Furst Dr., Glen Jean, WV

HBAWV Annual Conference – October 27th – 28th, 2023 – The Blennerhassett, Parkersburg, WV

Future NAHB Board of Directors Meetings

IBS

February 25-29, 2024 – Las Vegas

Spring Midyear Meetings:

Leg Con:

June 6th – 10th, 2023 – Washington, D.C.

Fall Meeting:

September 19th – 21st, 2023 – Palm Springs, CA